At the time of the publication of this report, the UK Government is working to identify how pensions investment can best support its objective of sustainable economic growth while delivering the best outcome for savers. This report was commissioned by a group of large asset owning pension funds to provide evidence and insight to better inform this important discussion.

29.4 million people have retirement savings invested with a large UK asset-owning pension fund. These funds’ core purpose is to support better retirement incomes for their members, using sophistication and scale to deliver efficient administration, security for members’ pension benefits, and appropriate risk-adjusted returns. Acting as a source of patient capital, large pension funds are in a better position than many other investors to invest over time periods lasting many decades.

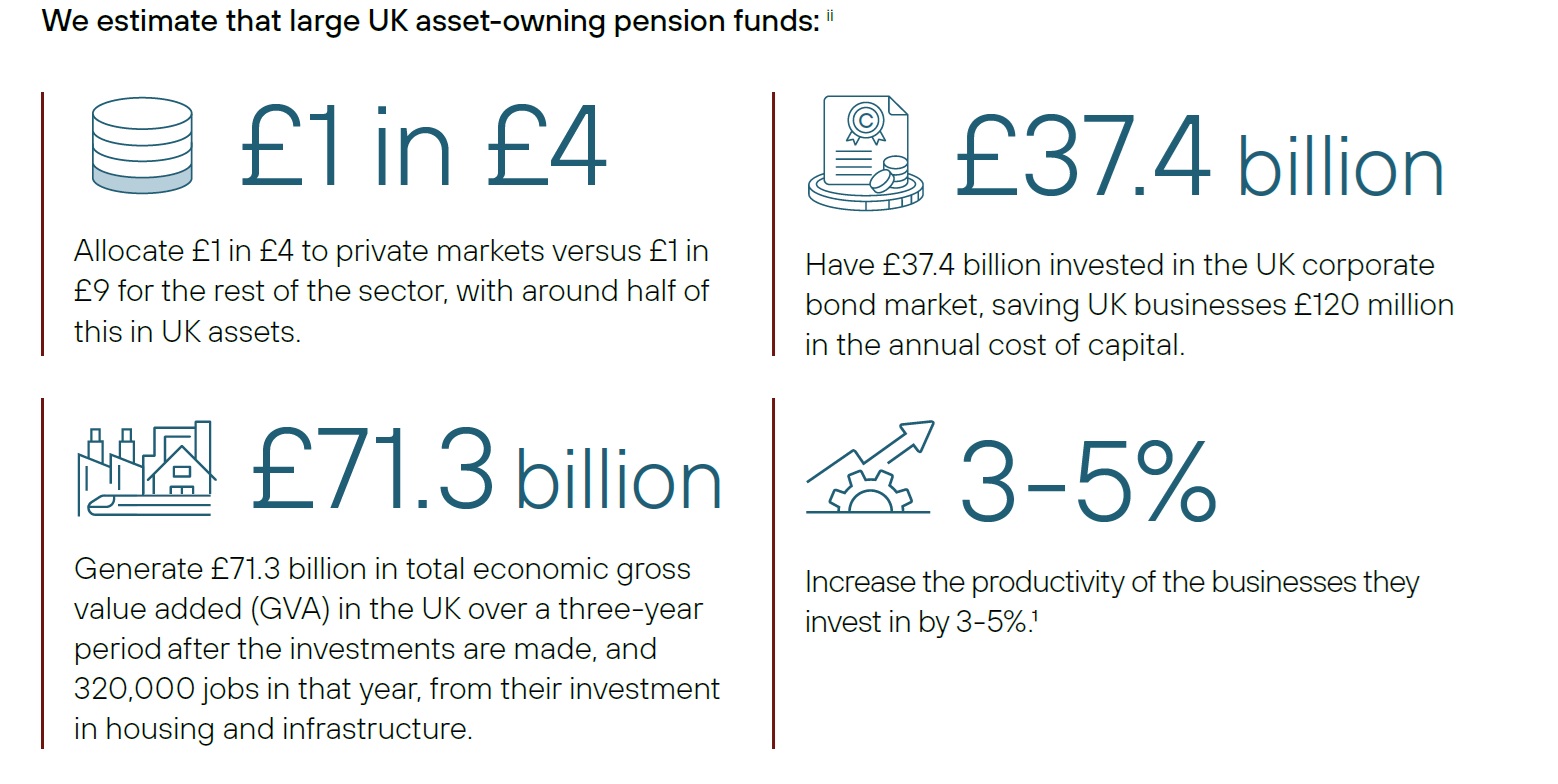

Through an extensive evidence review and economic modelling, our research has identified wider-reaching benefits from the activity and investments of large UK pension funds, which include:

- Investments in infrastructure and housing that generate an estimated £71.3 billion in total economic gross value added (GVA) in the UK over a three-year period after the investment is made and around 320,000 jobs in that year.

- £37.4 billion invested in the UK corporate bond market, saving UK businesses £120 million in the cost of capital per annum.

- The allocation of £1 in £4 to private markets versus £1 in £9 for the rest of the sector, with around half of this in UK assets.

Large UK pension funds have an estimated £280 billion invested in the UK economy across a range of assets. The scale and sophistication of these large pension funds enables them to pursue advanced investment strategies in UK private markets and to secure greater access to global opportunities, supporting diversification. This in turn supports the UK Government’s objective of sustainable long-term economic growth.